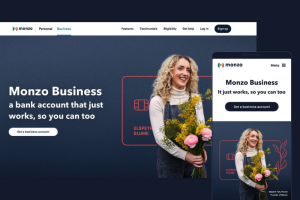

Find & Compare The Best Business Bank Account in Minutes

Discover the best business bank accounts with no hassle. Compare fees, features, and benefits in one place – FOR FREE!

Discover the best business bank accounts with no hassle. Compare fees, features, and benefits in one place – FOR FREE!

We're a 100% free tool and it only takes a minute to get started.

See the best business accounts tailored for you.

Apply and start banking in no time.

Tide has been recognised as the top choice for business banking for years. With its innovative solutions and unmatched customer satisfaction, Tide continues to help businesses thrive.

You also get £25 free when you open a Tide account!

*Based on over 20,000 reviews, with 71% awarding 5 stars for exceptional business banking services.

Not all business bank accounts are created equal. Here are the key features to consider when making the right choice for your business.

Choose an account that offers expert guidance and reliable customer service.

“Compare My Banking made it easy to compare and find the perfect account for my business needs!”

Janine Campo, Small Business Owner

In just three quick steps, you’ll find the best business bank account tailored to your needs. No hassle, no wasted time—just smart financial decisions.

Answer a few simple questions about your business—it only takes a minute.

View personalised results, side-by-side, and choose the one that works best for you.

Click to apply directly and get started with your new account in no time.

We personalise the process so you see only the best accounts for your business, making your decision faster and easier.

Our platform filters out irrelevant accounts, showing you only the options that suit your business size, type, and goals.

Say goodbye to time-consuming searches—find the perfect account in just a few clicks.

Compare trusted providers side by side with clear details, so you can make a confident decision.

Dentist

“The comparison process was seamless. I found the perfect account in minutes. Highly recommended!”

Accountant

“I couldn’t believe how easy it was. The tailored results saved me so much time. Fantastic service!”

Catering

“Exactly what I needed. The platform is clear, simple, and incredibly effective. Saved me heaps of time!”

Don’t waste time searching—get tailored results and exclusive deals in just minutes. Your ideal bank account is waiting.

A business bank account is designed to help businesses manage their finances separately from personal accounts. It simplifies tasks like tax returns, expense tracking, and cash flow management, while also providing clear statements that can support business growth plans.

While not legally required for most businesses, having a business bank account is highly recommended. It keeps personal and business finances separate, simplifies accounting, and enhances your credibility with clients and suppliers. Many accounts offer tailored features like overdrafts and software integration to save time and improve financial management.

For limited companies, a business bank account is legally required, as company finances must remain separate to avoid penalties from HMRC. Without one, you risk errors in tax reporting or fines.

Some banks may request additional documents during the application process, but they’ll guide you through what’s needed.

Steps to switch:

Many banks offer switching incentives, so it’s worth shopping around for the best deal. Before switching, ensure the new account has all the features and benefits your business requires.

Specific features vary between banks, so it’s worth comparing options to find what works best for your business.

Advantages:

Disadvantages:

Weigh these factors to decide if a business account is right for your needs.